UAE power mix will continue to be dominated by thermal power

Eexcerpt from PEI

Due to the presence of large gas and oil reserves in the United Arab Emirates (UAE), thermal power will continue to dominate the power generation mix during 2023-35, says data and analytics company GlobalData.

GlobalData’s latest report, UAE Power Market Size, Trends, Regulations, Competitive Landscape and Forecast, 2024-2035 reveals that the installed capacity share of thermal power in the UAE was around 80.4% in 2023, where gas-based thermal power capacity dominated the power capacity mix with a share of 80.2%.

With the discovery of more onshore hydrocarbon reserves, the UAE is aiming to become self-sufficient in gas supply by the year 2030, as currently, the country is dependent on gas imports for power plants and water desalination plants.

Sudeshna Sarmah, power analyst at GlobalData, commented, “With the discovery of new hydrocarbon reserves, the UAE is planning to invest heavily in hydrocarbon infrastructure and seek to develop new production techniques. At present, the country is in the process of choosing new locations to set up new infrastructure and seeking unconventional methods for hydrocarbon production.”

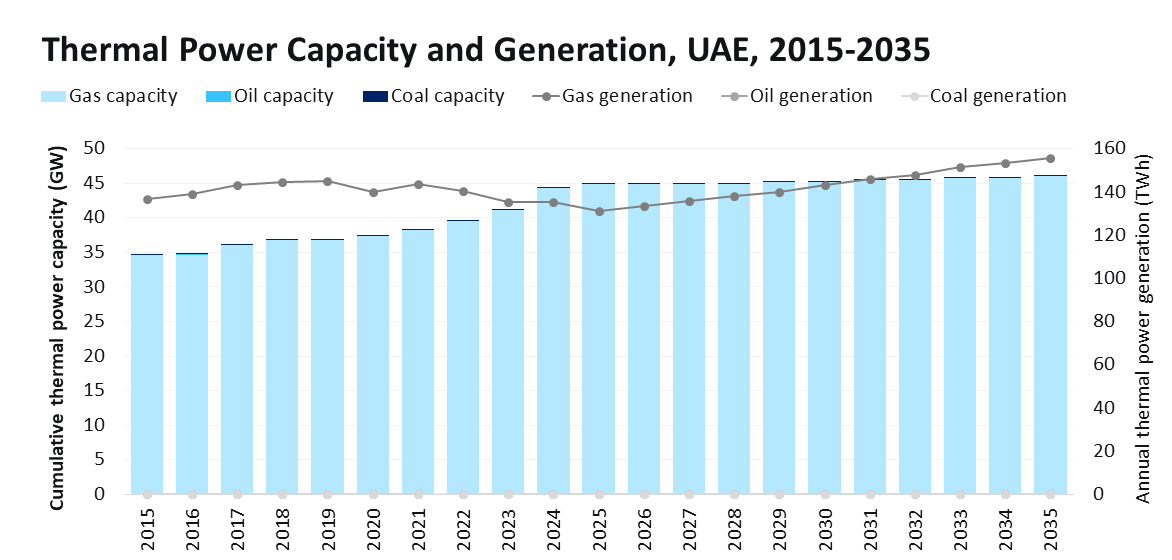

In 2023, gas was the dominant technology, contributing around 99.8% of thermal capacity. Oil and coal contributed around 0.1% each, respectively. By 2035, the cumulative thermal power capacity is expected to increase further to 46.1GW from 41.2GW in 2023, rising at a compound annual growth rate (CAGR) of 0.9% during the period. Annual generation from thermal power sources is estimated to rise from 135.5TWh in 2023 to 155.9TWh in 2035, increasing at a CAGR of 1.2%.

Sarmah added, “Most of the increase in capacity is expected in gas-based thermal power rather than oil, whose capacity is expected to remain almost unchanged. The increase in gas capacity provides a potential opportunity to industry stakeholders which include gas turbine manufacturers, ancillary equipment suppliers, developers, operators, and EPC contractors.”

Sarmah concluded, “Since 1971, the UAE has relied on its large oil and natural gas resources to support its economy. Rapid economic and demographic growth over the past decade has pushed the UAE’s electricity grid to its limits. The UAE is planning to add nuclear, renewable, and coal-fired electricity generating capacity to accommodate rising demand. Despite the UAE’s vast resource potential for renewables (particularly solar), only small progress has been made in the direction of harnessing renewable energy resources.”